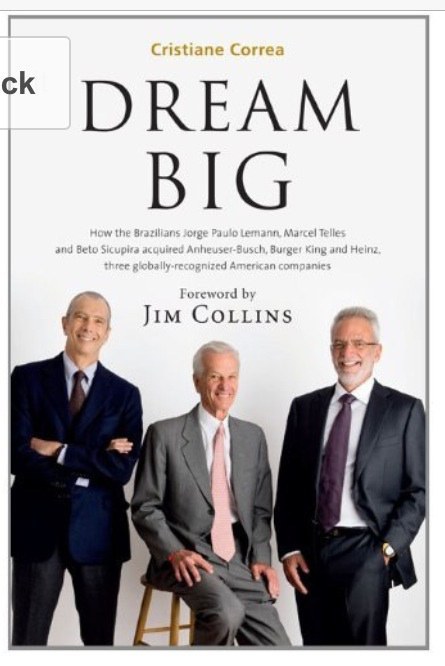

书名:Dream BigHowtheBrazilianTriobehind3GCapital-JorgePauloLemann,MarcelTellesandBetoSicupiraAcquiredAnheuser-Busch,BurgerKingandHeinz

作者:CristianeCorrea

译者:

ISBN:9788543100838

出版社:Sextante

出版时间:2014-1-1

格式:epub/mobi/azw3/pdf

页数:252

豆瓣评分: 7.5

书籍简介:

My friend – and now partner – Jorge Paulo and his team are among the best businessmen in the world. He is a fantastic person and his story should be an inspiration to everybody, as it is for me." – Warren Buffett In just over forty years, Jorge Paulo Lemann, Marcel Telles and Beto Sicupira built the biggest empire in the history of Brazilian capitalism and launched themselves onto the world stage in an unprecedented way. Over the past five years, they have acquired no fewer than three globally-recognized American brands: Budweiser, Burger King and Heinz. This has been achieved as discreetly as possible and they have shunned any personal publicity. The management method they developed, which has been zealously followed by their employees, is based on meritocracy, simplicity and constant cost cutting. Their culture is as efficient as it is merciless and leaves no room for mediocre performances. On the other hand, those who bring in exceptional results have the chance to become company partners and make a fortune. Dream Big presents a detailed behind-the-scenes portrait of the meteoric rise of these three businessmen, from the founding of Banco Garantia in the 1970s to the present day. In 1971, when the Brazilian stock market was going through an euphoria, Harvard graduate, tennis champion and underwater fishing enthusiast from Rio de Janeiro Jorge Paulo Lemann decided to start a new business. He assembled some partners and put out a newspaper ad: "Brokerage wanted." Days later, Lemann began running what would become the cornerstone of his fortune and those of over 200 other people. Its name was Garantia. The "Garantia model" was based on businesses that impressed Lemann, such as Goldman Sachs in finance and Walmart in retail. Its philosophy gave the best workers the opportunity to become shareholders.

作者简介:

作者:

克里斯蒂娜·柯利娅,巴西资深记者、知名的商业和管理咨询顾问。供职巴西最畅销的商业杂志《检视》(Exame)执行编辑12余年。其间她参与了几十篇针对巴西大型公司的深度报告。

译者:

王仁荣,法学博士,百威英博亚太区副总裁。2003年加入百威英博,和雷曼、马塞尔、贝托3G“三剑客”相识、共事13年,先后参与了“英特布鲁收购美洲饮料”“英博收购百威”以及世纪并购“百威英博收购南非米勒”等一系列大型跨境并购案。他也是百威英博在中国及亚太地区并购扩张的亲历者。

书友短评:

@ 一味药 poor, smart, desire @ mingjiwu 巴西人写书真是记流水账… @ 目送飞鸿 https://abookaweek.zbf.me/dream-big-du-hou-gan-ge-dian-xing-lang-han-de-meng-xiang-zhi-lu @ uh duh 名气很大,实质内容极度极度一般,毫无干货,当故事书看 @ 目送飞鸿 巴西人写书真是记流水账… @ Flashing3 数次看到了和自己共鸣的部分,庆幸自己take the risks,巴西的昨天就是我们的今天。最好的时代! @ S. Wish it could cover the next 10 years @ 淡眼僧 企业文化很值得学习,meritocracy。

添加微信公众号:好书天下获取

好书天下

好书天下

评论前必须登录!

注册