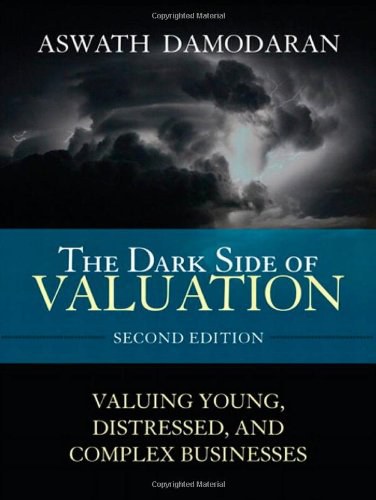

书名:The Dark Side of ValuationValuingYoung,Distressed,andComplexBusinesses

作者:AswathDamodaran

译者:

ISBN:9780137126897

出版社:FTPress

出版时间:2009-7-27

格式:epub/mobi/azw3/pdf

页数:600

豆瓣评分: 8.8

书籍简介:

The Definitive Guide to Valuing Hard-to-Value Companies: Now Fully Revised for Today’s Financial Markets Financial professionals have long faced the challenge of accurately valuing companies that are difficult to value using conventional methodologies. Years ago, this challenge was most keenly felt in the “dot-com” industries, and many professionals fell victim to the “dark side,” creating values that were simply unsustainable. Now, amidst today’s global financial crisis, the same challenge applies to a far wider spectrum of enterprises and assets, ranging from Asian equities to mortgage-backed securities and financial services firms. Aswath Damodaran has thoroughly revised this book, broadening its perspective to consider all companies that resist easy valuation. He covers the entire corporate lifecycle, from “idea” and “nascent growth” companies to those in decline and distress, and offers specific guidance for valuing technology, human capital, commodity, and cyclical firms. Damodaran places special emphasis on the financial sector, illuminating the implications of today’s radically changed credit markets for valuation. Along the way, he addresses valuation questions that have suddenly gained urgency, ranging from “Are U.S. treasuries risk free?” to “How do you value assets in highly illiquid markets?” Vanquishing the “dark side” Overcoming the temptation to use unrealistic or simplistic valuation methods Revisiting the macro inputs that go into valuation What you must know about risk-free rates, risk premiums, and other macroeconomic assumptions Valuing idea and nascent companies: the first stages of entrepreneurial valuation Intelligent analysis for angel and early venture capital investing Special challenges associated with valuing financial services firms Includes new insights into projecting the impact of regulatory changes Best practices and proven solutions from the world’s #1 expert in valuation, Aswath Damodaran Now covers all industries and all stages of the corporate lifecycle Includes extensive new coverage of valuing financial services and commodities companies What’s that company or asset really worth? The question is more urgent than ever: We’ve all discovered the havoc that can be caused by misvaluing assets and companies. But some assets are extremely difficult to price with traditional methods. To accurately value them, start with the techniques and best practices in this book. Renowned valuation expert Aswath Damodaran reviews the core tools of valuation, examines today’s most difficult estimation questions and issues, and then systematically addresses the valuation challenges that arise throughout a firm’s lifecycle. Next, he turns to specific types of hard-to-value firms, including commodity firms, cyclical companies, financial services firms, organizations dependent on intangible assets, and global firms operating diverse businesses. Damodaran’s insights will be indispensable to everyone involved in valuation: financial professionals, investors, M&A specialists, and entrepreneurs alike.

作者简介:

埃斯瓦斯•达莫达兰(Aswath Damodaran)

纽约大学斯特恩商学院金融学教授,全球最受推崇的估值和财务专家。达莫达兰著有《达莫达兰之估值》《投资估值》《公司财务:理论与实践》《应用公司财务:用户手册》,新作《战略风险的担当》深入探讨了该如何看待风险和风险管理。达莫达兰曾七次获得斯特恩商学院的卓越教学奖,1994年并被《商业周刊》评为美国十大顶级商学院教授。

书友短评:

@ LoveDivine 读过中文版,有许多案例,很不错 @ Chung-Wan 越来越读不下去这种教材式的 @ EstefaniaWU corporate finance的高级读本,对基本模型实用性的讨论与拓展 @ LoveDivine 读过中文版,有许多案例,很不错 @ Chung-Wan 越来越读不下去这种教材式的 @ EstefaniaWU corporate finance的高级读本,对基本模型实用性的讨论与拓展

添加微信公众号:好书天下获取

好书天下

好书天下

评论前必须登录!

注册