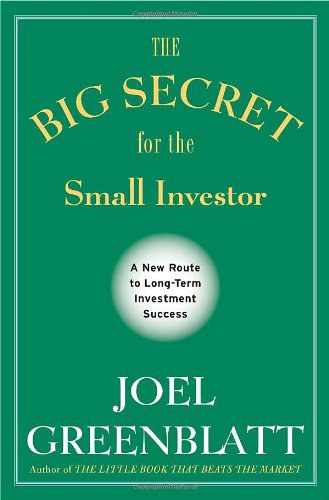

书名:The Big Secret for the Small InvestorANewRoutetoLong-TermInvestmentSuccess

作者:JoelGreenblatt()

译者:

ISBN:9780385525077

出版社:CrownBusiness

出版时间:2011-4-1

格式:epub/mobi/azw3/pdf

页数:160

豆瓣评分: 6.6

书籍简介:

When it comes to investing in the stock market, investors have plenty of options: 1. They can do it themselves. Trillions of dollars are invested this way. (Of course, the only problem here is that most people have no idea how to analyze and choose individual stocks. Well, not really the only problem. Most investors have no idea how to construct a stock portfolio, most have no idea when to buy and sell, and most have no idea how much to invest in the first place.) 2. They can give it to professionals to invest. Trillions of dollars are invested this way. (Unfortunately most professionals actually underperform the market averages over time. In fact,it may be even harder to pick good professional managers than it is to pick good individual stocks.) 3. They can invest in traditional index funds. Trillions of dollars are also invested this way.(The problem is that investing this way is seriously flawed–and almost a guarantee of subpar investment returns over time.) 4. They can read The Big Secret for the Small Investor and do something else. Not much is invested this way. Yet… Let top hedge fund manager, Columbia business school professor, former Fortune 500 chairman and New York Times bestselling author, Joel Greenblatt, take you on a journey that will reveal the Big Secret for both individual and professional investors. Based on path-breaking new research, find out how anyone can beat the market, the index funds and the experts by following a new approach that relies on the principles of value investing, common sense and quantitative discipline. Along the way, learn where "value" comes from, how markets work, and what really happens on Wall Street. By journey's end, small investors (and even not-so-small investors) will have found their way to some excellent new investment choices.

作者简介:

小弗雷德·施韦德

(Fred Schwed, Jr.)

20世纪20年代初期,已经读到大学四年级的小弗雷德因为晚上6点在宿舍里容留女生而被普林斯顿大学劝退,之后他就在华尔街谋生。作为一名职业交易员,他在1929年的崩盘中破了产。尽管施韦德只在华尔街干了几年,关于这些经历也只写了《客户的游艇在哪里》一本书,但这并不妨碍它成为精品,并得到巴菲特盛赞。

施韦德喜欢打高尔夫,工作时喝点小酒,只有几部作品问世,现在为人熟知的是一本叫《小男孩沃奇》的儿童读物。施韦德的出版商对他的评价是:“施韦德先生曾先后就读于劳伦斯威尔大学和普林斯顿大学,近10年一直在华尔街工作,因此他对怎样描写儿童无所不知。”

他一定很喜欢自己的书。

书友短评:

@ Jessie 还不错的一本小书,一步一步娓娓道来。强调价值与纪律的重要性。 @ 大毛光光头 一般,把他在另一本little book that beats the market里的话又说了一遍 @ 未知的老鼠☂ 332.6 GRE @ 羊香鱼有有 332.6 GRE @ 宝宝TWO 非常好的作者,前面70%的篇幅都在回答一个接连一个的存在内部逻辑,又很根源的问题,然而提出了Value Weighted Index这个解决方法,书很不错,答案也没毛病,就是深度可以再多一点。读起来还是很轻松欢乐的 @ 专注 有點炒冷飯的感覺,和他寫的前一本書的内容相近。 @ 未知的老鼠☂ 2017.5.18想读;2017.6.7早上读完。非常受用。整体逻辑是,对投资者而言,大多数mutual fund在扣费之后根本跑不过指数基金,那比指数基金更好的呢?就是本书的答案——平均化投资的指数基金,以及低估股票构成的指数基金。

添加微信公众号:好书天下获取

好书天下

好书天下

评论前必须登录!

注册