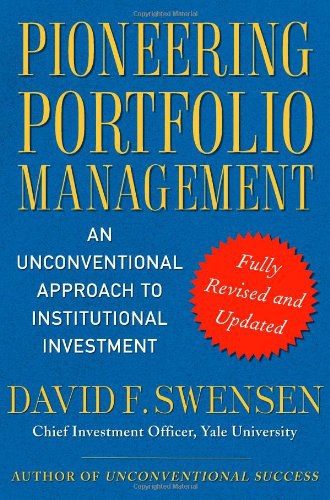

书名:Pioneering Portfolio ManagementAnUnconventionalApproachtoInstitutionalInvestment,FullyRevisedandUpdated

作者:DavidF.Swensen

译者:

ISBN:9781416544692

出版社:FreePress

出版时间:2009-1-6

格式:epub/mobi/azw3/pdf

页数:432

豆瓣评分: 8.8

书籍简介:

During his fourteen years as Yale's chief investment officer, David F. Swensen has transformed the management of the university's portfolio. Largely by focusing on nonconventional strategies, including a heavy allocation to private equity, Swensen has achieved an annualized return of 16.2 percent, which has propelled Yale's endowment into the top tier of institutional funds. Now, this acknowledged leader of fund managers draws on his experience and deep knowledge of the financial markets to provide a compendium of powerful investment strategies. Swensen presents an overview of the investment world populated by institutional fund managers, pension fund fiduciaries, investment managers, and trustees of universities, museums, hospitals, and foundations. He offers penetrating insights from his experience managing Yale's endowment, ranging from broad issues of goals and investment philosophy to the strategic and tactical aspects of portfolio management. Swensen's exceptionally readable book addresses critical concepts such as handling risk, selecting investment advisers, and negotiating the opportunities and pitfalls in individual asset classes. Fundamental investment ideas are illustrated by real-world concrete examples, and each chapter contains strategies that any manager can put into action. At a time when it is becoming increasingly difficult to cope with the relentless challenges provided by today's financial markets, Swensen's book is an indispensable roadmap for creating a successful investment program for every institutional fund manager. Any student of markets will benefit from Pioneering Portfolio Management.

作者简介:

David F. Swensen is Yale University's Chief Investment Officer and manages the university's $7 billion dollar endowment as well as several hundreds of millions of dollars in other investment funds. He serves as a Trustee of the Carnegie Institution of Washington, Director of the Investment Fund for Foundations, Member of the Hopkins Committee of Trustees and Member of the Investment Advisory Committees for the Howard Hughes Medical Institute and the State of Massachusetts. Mr. Swensen also teaches classes on portfolio management at Yale in New Haven

书友短评:

@ 越越你妹 主要讲机构投资,非常详尽,不是一般读者能读懂的 @ Tyler 总结下来两点最重要。第一是长期的investment horizon,第二是在asset class和manager层面考虑conflict of interest @ Kevin Lee 本书主要阐述了耶鲁大学捐赠基金作为机构投资者的投资方法,具有借鉴意义的是对于资产配置的方法。重点阅读了第4,5,6章。 @ Mr.Fox well-rounded structured @ 绅士学长小宇 组合管理实为日拱一卒,看到局限才能行至千里。然而,知易行难也。 @ 庄常飞 IC @ Joseph – how to allocate illiquid assets- how to test portfolios- cases of real estates @ au_milieu 有点唐僧地scratch the surface,不过深了我也看不懂,总之跳着看的,还是有帮助的 @ Charlie 这本书最大的收获是了解了各种资产的特性以及机构是如何管理他们的资产组合。 作为个体投资者,这本书帮我了解我的对手是怎么思考的,反其道而行之,才能获得超出市场的回报。资产组合以及再平衡的相关内容也非常又价值,接下来需要把这些概念用到新的投资组合管理上。

添加微信公众号:好书天下获取

好书天下

好书天下

评论前必须登录!

注册