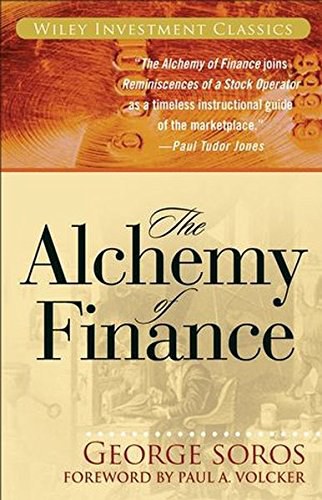

书名:The Alchemy of FinanceReadingtheMindoftheMarket

作者:GeorgeSoros

译者:

ISBN:9780471445494

出版社:Wiley

出版时间:2015-6-15

格式:epub/mobi/azw3/pdf

页数:391

豆瓣评分: 8.8

书籍简介:

在线阅读本书 Book Description New chapter by Soros on the secrets to his success along with a new Preface and Introduction. New Foreword by renowned economist Paul Volcker "An extraordinary … inside look into the decision-making process of the most successful money manager of our time. Fantastic." – "The Wall Street Journal". George Soros is unquestionably one of the most powerful and profitable investors in the world today. Dubbed by "BusinessWeek" as "the Man who Moves Markets," Soros made a fortune competing with the British pound and remains active today in the global financial community. Now, in this special edition of the classic investment book, "The Alchemy of Finance", Soros presents a theoretical and practical account of current financial trends and a new paradigm by which to understand the financial market today. This edition's expanded and revised Introduction details Soros's innovative investment practices along with his views of the world and world order. He also describes a new paradigm for the "theory of reflexivity" which underlies his unique investment strategies. Filled with expert advice and valuable business lessons, "The Alchemy of Finance" reveals the timeless principles of an investing legend. This special edition will feature a new chapter by Soros on the secrets of his success and a new Foreword by the Honorable Paul Volcker, former Chairman of the Federal Reserve. George Soros (New York, NY) is President of Soros Fund Management and Chief Investment Advisor to Quantum Fund N.V., a GTB 12 billion international investment fund. Besides his numerous ventures in finance, Soros is also extremely active in the worlds of education, culture, and economic aid and development through his Open Society Fund and the Soros Foundation. Book Dimension length: (cm)22.8 width:(cm)15.4

作者简介:

乔治・索罗斯也许是有史以来知名度最高和最具传奇色彩的金融大师。1993年,他利用欧洲各国在统一汇率机制问题上步调不一致的失误,发动了抛售英镑的投机风潮,迫使具有300年历史的英格兰银行(英国中央银行)认亏出场。1997年2月,他旗下的投资基金在国际货币市场上大量抛售泰铢,这一行动被视为是牵连极广、至今尚未平息的东南亚金融危机的开端。当然,索罗斯也并非无往而不胜。在1987年美国股灾中,索罗斯亏损4~6亿美元,而他在1998年俄罗斯金融危机中的亏损更高达30亿美元之巨。尽管如此,他所经营的量子基金并未因损失惨重而清盘,索罗斯也一如既往地在纽约中央公园旁的办公室里评判市场,不断发表令市场为之震颤的独家观点。

书友短评:

@ c h l "Economic history is a never-ending series of episodes based on falsehoods and lies, not truths. It represents the path to big money. The object is to recognize the trend whose premise is false, ride that trend, and step off before it is discredited." @ 索罗斯是看过易经吧?reflexity不就是物极必反,盛极而衰。绝望中才会产生希望,而烈火烹油正是大厦将倾的前兆。一个好投资的必要条件是要有足够多的人认为它不好。

添加微信公众号:好书天下获取

好书天下

好书天下

评论前必须登录!

注册